Bengwenyama

Summary

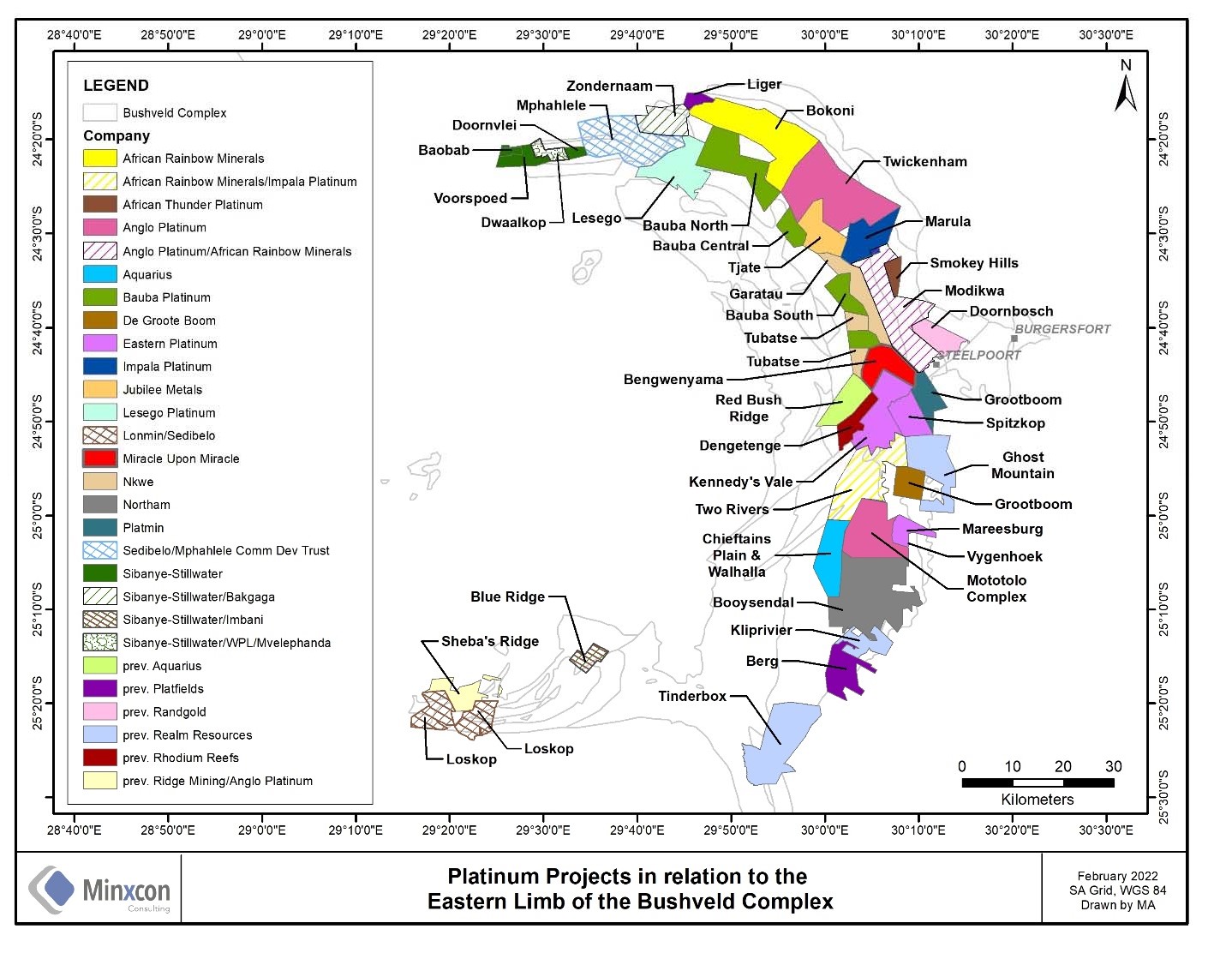

The Project is an advanced stage exploration project focussed on PGM mineralisation on the Properties which are located on the Eastern Limb of the Bushveld Complex and south of the Anglo Platinum Modikwa property. Two economical reefs – the Merensky and UG2 reefs – occur on the Properties, which extend from surface to a depth of 1,100m over a distance of 10km. Both these reefs are primary economic deposits exploited by other platinum mining companies for PGMs and base metals in the region.

A recent compliant (JORC 2012) Inferred Mineral Resource (CSA, Stated 1 July 2021) of 18.80 Moz 3PGE+Au has been estimated for the Project. Based on the volume, grade and depth of the reefs, and the similarity with other projects and operations in the area and other parts of the Bushveld Complex, the resource is deemed to have reasonable prospects for eventual economic extraction. Based on the exploration target ranges, over and above the Inferred Mineral Resource, the project also has additional upside potential with an additional 134-201 Mt at 3.5-5.2 g/t 3PGE+Au in Exploration Target.

The reefs can be extracted from underground mining with a relatively short lead time to production, and with ore processed by means of conventional proven methods used extensively throughout the Bushveld Complex. The Properties are in close proximity to existing mining activities and assets, as well as other essential infrastructure.

Figure 14: Bengwenyama Platinum Project Location on the Eastern Limb of Bushveld Complex

Location and Access

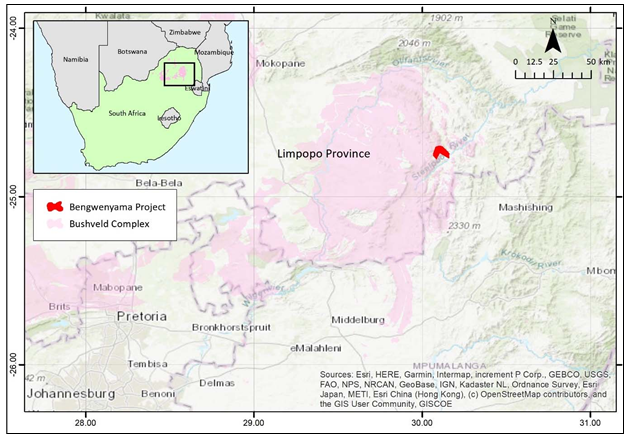

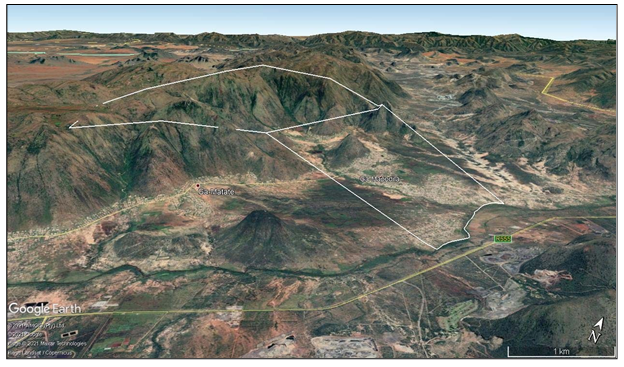

The Project comprises the full extent of the Properties. At its closest point, the Project lies approximately 5 km west of the village of Steelpoort, 20 km west-southwest of the larger town of Burgersfort, and 250 km east-northeast of Pretoria. The Project has a total areal extent of 5,279.74 ha.

Figure 15: Regional locality map, with the extent of the Bushveld Complex indicated

The Project is accessible via a sealed (tarred) road which branches off the R555 main road that runs just to the south of the Project area. The lower elevation reaches of the Project are easily accessible by vehicle, whereas the more mountainous parts are accessible on foot. It is well serviced by existing infrastructure, with the exception of the high ground on farm Nooitverwacht 324KT. Although mining-related surface infrastructure is not yet established at the Project, the region is well serviced by mining infrastructure and labour. Grid power and reliable water sources are available for potential exploration and mining operations.

Figure 16: Northwest-facing view across Eerste Geluk (foreground) and Nooitverwacht (vertical exaggerationis 2x)

Preferent Prospecting Right

MUM was granted a Preferent Prospecting Right LP30/5/1/1002PPR over the Properties, granted in accordance with Section 104 of MPRDA on 10 June 2015, for an initial period of five years. The Preferent Prospecting Right covers PGMs, gold, copper, chrome, cobalt, silver, and nickel. Preferent prospecting and mining rights are specifically granted to local communities. A renewal was granted on 13 February 2021 and the renewed Preferent Prospecting Right is valid until 12 February 2024.

Geology

(a) Setting

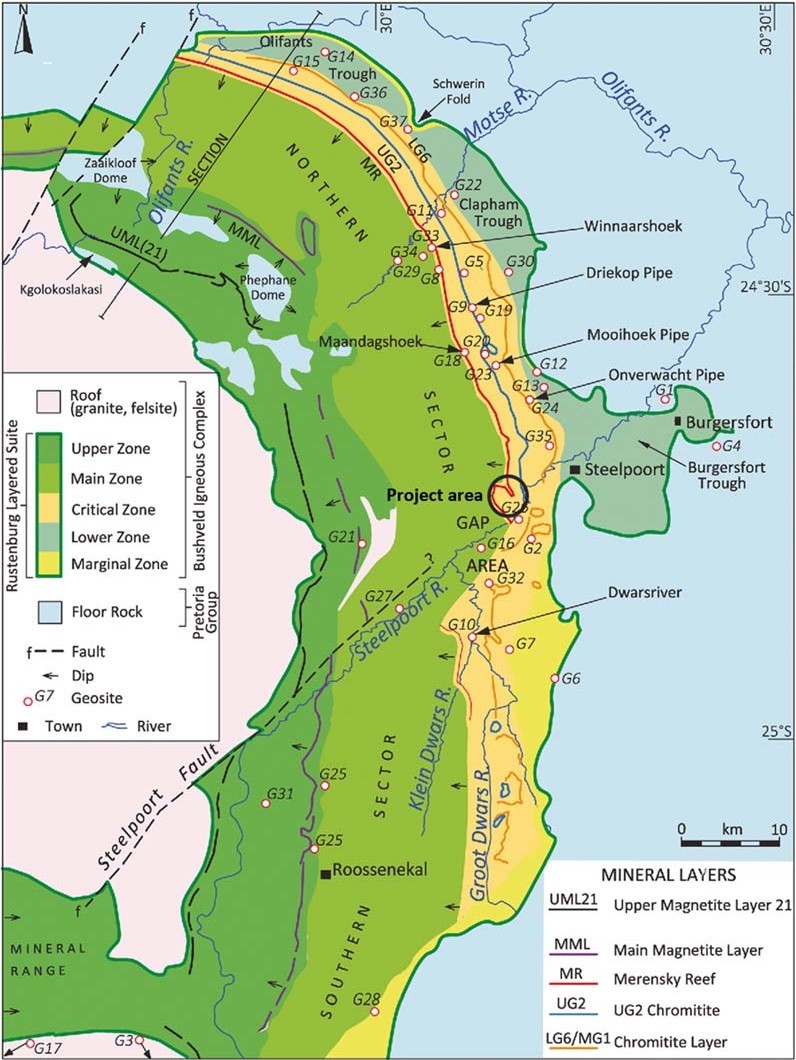

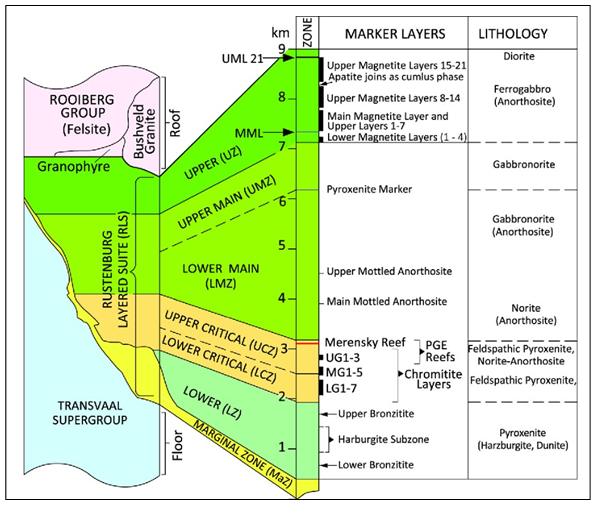

The Project occurs within the Eastern Limb of the Bushveld Complex, layered igneous intrusion, which is globally the most important source of PGEs. The Bushveld Complex is characterised by significant lateral continuity of the igneous layering in the complex, with individual layers being traceable and frequently uniform for tens to hundreds of kilometres.

Figure 17: Generalised map of the Eastern Limb. Source: Modified from Scoon and Viljoen (2019)

The primary PGE deposit types within the Bushveld Complex are the stratiform layers (reefs) that occur within the Upper Critical Zone. These include the Merensky Reef and UG2 which are present throughout the Rustenburg Layered Suite, mineralised throughout their extent and characterised by significant lateral geological and grade continuity, with the exception of local disruptive features such as potholes, discordant iron-rich pegmatoids, dykes and faults. A subordinate, but increasingly important deposit type is those formed at the contact of the Rustenburg Layered Suite with the floor rocks.

Figure 18: Simplified stratigraphy of the Rustenburg Layered Suite. Source: Scoon and Viljoen (2019)

(b) Mineralisation

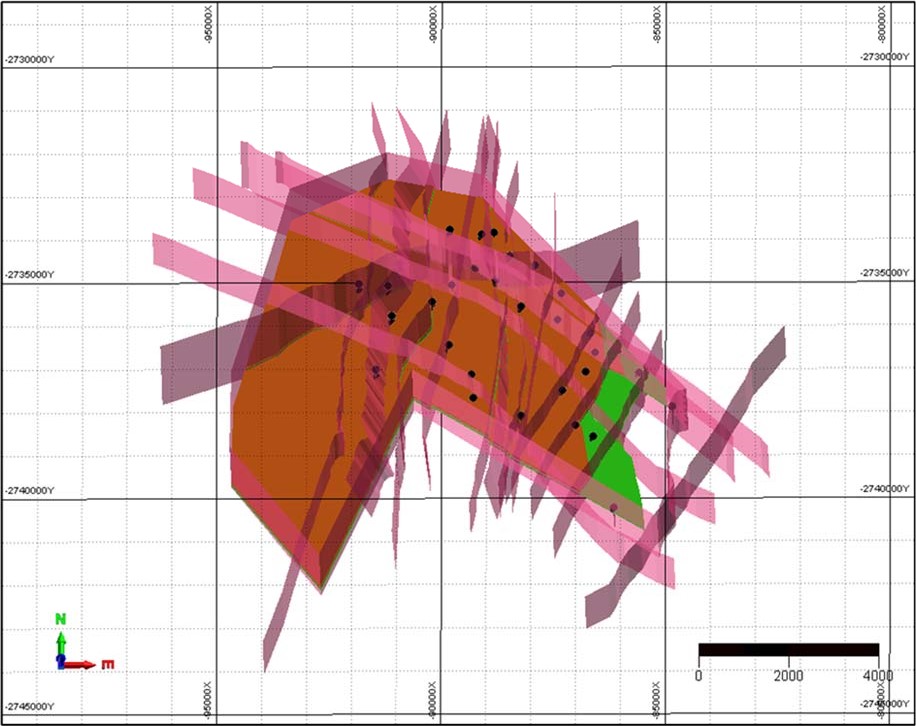

Both the Merensky Reef and UG2 occur on the Project. The effects of floor rock deformation related to the diapiric rise of a large floor dome, the Steelpoort pericline, is only present on the eastern part of farm Eerstegeluk 327KT and does not impact the Mineral Resource area, and both the Merensky Reef and UG2 in the Mineral Resource area dip reasonably uniformly to the west at between 10° and 20°. Brittle faulting, related to the regional Steelpoort Fault, is present and has resulted in a series of smaller-scale faults in the Project that have raised or lowered the Merensky Reef and UG2. The UG2 at the Project ranges in thickness from 0.2 m to 1.14 m, averaging approximately 70 cm, whereas the Merensky Reef is between 0.2 m and 5.71 m thick, averaging approximately 2 m.

Figure 19: Oblique view looking north, showing drillhole traces (black), Merensky surface (orange), UG2 surface (green), faults and dykes (transparent red)

Previous Work

Historical drilling was undertaken by Rustenburg Platinum Mines Limited from about 1966 to 1985. Incomplete records of four drillholes are available and no reliance has been placed on these due to the incompleteness of the data. Trojan Exploration also completed some exploration on farm Eerstegeluk 327KT during the period 1990 to 1993, focused on the chromite potential at farm Eerstegeluk 327KT.

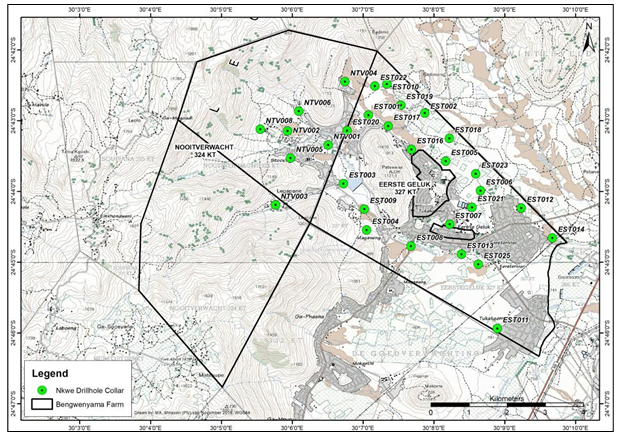

The Properties were explored by Nkwe Platinum Limited (Nkwe) as part of its Tubatse project. Nkwe undertook reconnaissance mapping, a geophysical interpretation and diamond drilling. A total of 30 diamond drill mother holes were drilled in 2007 and 2008, with at least 69 deflections recorded. The Nkwe disclosures were incomplete and therefore not all data from every hole is available. Assay results, thicknesses and collar positions have been reported for 21 mother holes and 52 deflections. A new aeromagnetic and radiometric survey was commissioned by MUM and completed in January 2022 over 1,425 linear km at a line spacing of 50m and average height of approximately 35-40m. This data is currently being processed for interpretation.

Figure 20: Nkwe drillhole collars, Nooitverwacht and Eerste Geluk

Core diameter was not reported but is likely to have been NQ (47.50-47.75 mm). Deflections, drilled by placing a wedge in the drillhole, were most likely drilled in TBW diameter (45.09-45.34 mm). Drill recovery information was also not reported, however, recovery of Bushveld core, away from fault zones or contacts with intrusive material, is expected to be high due to the competent nature of the rocks. No information about the geological or geotechnical logging method is available, but the depths to the Merensky Reef and the UG2 are considered reasonable for the location of the Project.

Original drill cores, retained sample material and the original drilling database are not available; however, a dataset from the information disclosed by Nkwe has been constructed. Drillhole collars are still present in the field and several of these have been verified on 6 June 2016 - 10 June 2016, on several occasions thereafter with potential funders and more recently with CSA site visit on 9 April 2021. Despite dataset shortcomings, the results disclosed by Nkwe and compiled by MUM are sufficiently robust to support a Mineral Resource estimation.

Exploration Potential

The Eastern Limb of the Bushveld Complex has been proven to host economic PGE deposits in both the Merensky and UG2 reefs, with numerous operations established along its extent.

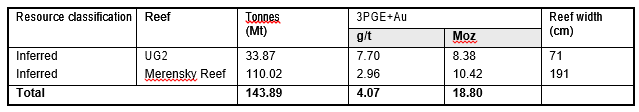

Based on available Nkwe data, an Inferred Mineral Resource has been estimated on 1 July 2021 and reported on 19 April 2022 in accordance with JORC (2012). Geological losses have been applied to account for reef material lost due to faulting, dykes, and potholes

Table 2: Mineral Resource for the Bengwenyama Project as at 01 July 2021

Notes:

- 3PGE+Au refers to platinum + palladium + rhodium + gold

- Mineral Resource cut-off is 2.2 g/t 3PGE+Au for UG2 and 1.2 g/t 3PGE+Au for Merensky

- Basket price used for the cut-off calculation is US$1,126/oz for UG2 and US$1,270/oz for Merensky

- Geological losses of 17% for the UG2 and 10% for the Merensky have been applied

- Figures may not add up due to rounding

- Mineral Resources are reported as total Mineral Resources and are not attributed.

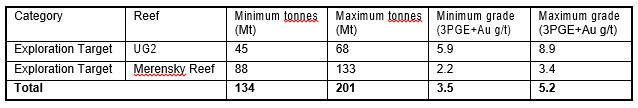

In addition, an Exploration Target is reported which is conceptual in nature. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

Table 3: Exploration Target for the Bengwenyama Project as at 01 July 2021

Notes:

- 3PGE+Au refers to platinum + palladium + rhodium + gold

- Cut-off is 2.2 g/t 3PGE+Au for UG2 and 1.2 g/t 3PGE+Au for Merensky

- Basket price used for the cut-off calculation is US$1,126/oz for UG2 and US$1,270/oz for Merensky

- Geological losses of 40% for the UG2 and 35% for the Merensky have been applied

- • Figures may not add up due to rounding

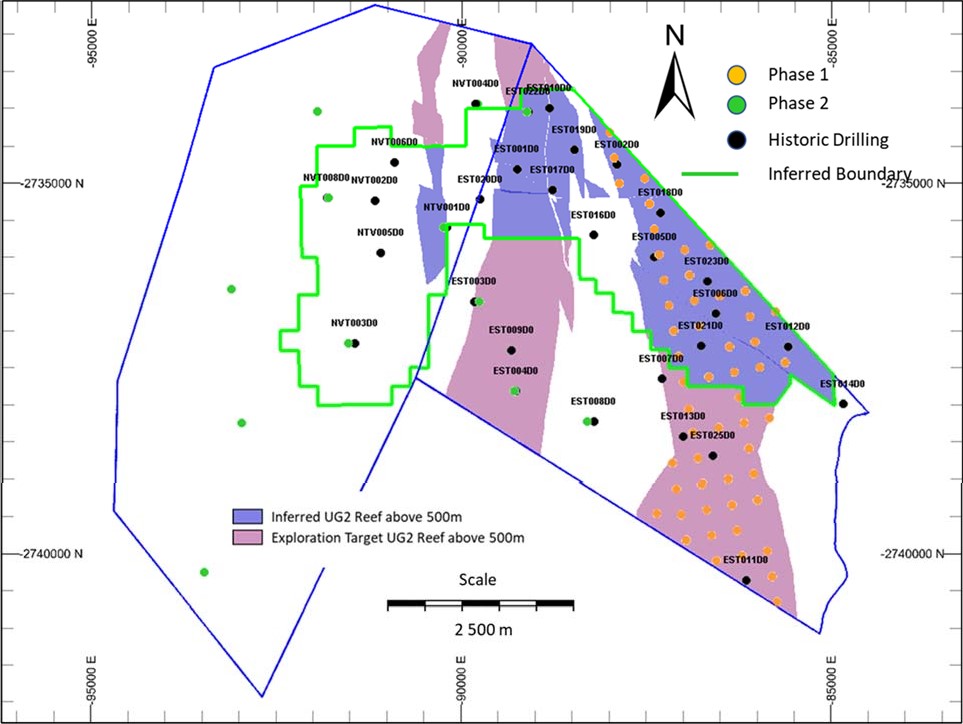

A dual phase drilling programme for some 38,000 m and study work are planned with the aim to upgrade the Mineral Resource classification in areas where the UG2 occurs at less than 500 m below surface. In addition, the conversion of existing Exploration Target material to Inferred Mineral Resources, is earmarked. This planned upgrade of the shallower portions of the UG2 will facilitate downstream economic studies and possibly the conversion of Mineral Resources to Ore Reserves, potentially culminating in the submission of a Mining Right Application. The progression of Mineral Resources to increasing levels of confidence is dependent on the outcome of infill drilling. Mobilisation onto the property will commence within a month following the listing and drilling soon thereafter (likely end of May early June).

Exploration Program

A diamond drilling programme over two phases is planned, targeting the current key milestones:

- Phase 1: Infill drilling of the shallowest portion of the deposit, which has been planned on a 350 m grid spacing, with the aim of upgrading the Mineral Resource confidence in this area to Indicated, to provide sufficient confidence to support downstream mining and economic studies. Provision has been made for some potential validation drilling of existing Nkwe intersections. The primary focus of Phase 1 drilling is the UG2 at depths less than 500 m (shaded area in the figure) and is concentrated on the farm Eerstegeluk 327KT. The maximum planned drillhole depth is 550m with an average depth of 288m. The drilling will start on a wider grid spacing and work toward a closer spaced grid. This will allow for changes in the drilling programme if the geological model should change significantly in the south eastern corner due to the possible domal structure.

- Phase 2: Widely spaced drilling within the Exploration Target area to potentially support upgrading this material to Inferred Mineral Resources. The wider spaced phase 2 drilling will improve the confidence in the entire project area and potentially allow for more accurate longer-term life of mine planning in the long run. This phase could also increase the value of the project with the total area possibly being upgraded to inferred. The maximum drillhole depth is estimated to be 2,040 m (due to the topography) with an average drilling depth of 932 m.

Figure 21: Planned drilling (Phase 1 and Phase 2)

A total of 63 drillholes are planned for Phase 1 over a total meterage of 24,464 m, while 12 drillholes are planned for Phase 2 over 13,582 m. The intention of the completion of the drilling programs is to facilitate an advanced study on the Project to support a Mining Right Application. Provision has been made for metallurgical testwork and statutory requirements set out by the MPRDA.

The drilling tender and adjudication process is already underway, and the drilling contractor is expected to be appointed in April 2022.

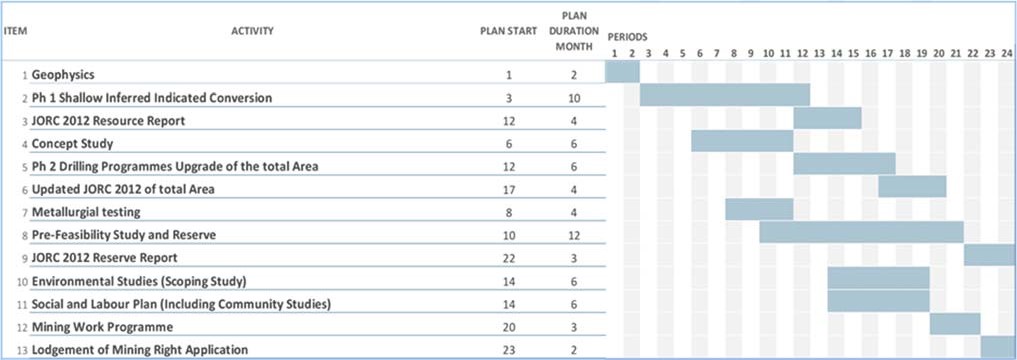

The schedule for this exploration programme is detailed in Figure 8-2. The helicopter airborne magnetic and radiometric geophysical survey was completed by NRG in the third week of January 2022. The data is being processed. The aim of the geophysical survey was to help confirm the structures of the geological model.

The logistical preparation for the drilling campaign has already begun and the drilling tender adjudication is in process. Negotiations with the Lebalelo water user association has also commenced for a non-member water use agreement for the water requirements of the drilling operations.

Phase 1 drilling will culminate in a JORC Mineral Resource Report with a concept study being completed simultaneously as phase 1 drilling. Phase 2 is planned to follow on from phase 1 if the results support this. The pre-feasibility study will follow on from the concept study and finalisation of phase 1, which should allow for the declaration of reserves which will support the lodging of the Mining Right Application. The environmental scoping study and social and labour plan will also be completed as part of the requirement for the Mining Right Application. The additional detailed studies such as the environmental studies will commence once the Mining Right has been lodged.

Figure 8-2: Exploration Programme Schedule to reach Project Milestones

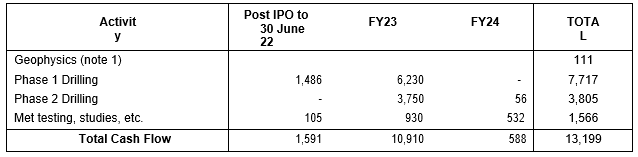

A total project budget, inclusive of associated study work, for the exploration and project development is provided Table 8-2. The exploration programme is planned at a maximum capital raise of $19million. Provision was made for environmental expert studies following the lodgement of the Mining right application.

Table 4-4: Proposed budget of exploration and project development (A$000)

Note:

1. This is the cost of the geophysics program that was incurred after 31 December 2021 and prior to the Prospectus Date. The program is now complete. The program was completed at a cost of $149,000.

2. In the event that only the Minimum Subscription is achieved, there will be no change to Phase 1 drilling, reports, Met testing and other studies. However, Phase 2 drilling and reports will reduce to $2,435,000.

3. Exchange rate - ZAR/AUD 11.20